Top Reasons to Choose VA Home Loans for Your Next Home Purchase

Top Reasons to Choose VA Home Loans for Your Next Home Purchase

Blog Article

Recognizing How Home Loans Can Promote Your Trip Towards Homeownership and Financial Stability

Navigating the intricacies of home loans is crucial for anybody aiming to accomplish homeownership and establish economic stability. As we think about these critical aspects, it comes to be clear that the path to homeownership is not just regarding protecting a financing-- it's about making notified options that can form your economic future.

Kinds of Home Loans

Conventional car loans are a prominent choice, generally requiring a greater credit report and a down repayment of 5% to 20%. These finances are not guaranteed by the government, which can lead to stricter credentials standards. FHA loans, backed by the Federal Housing Administration, are designed for first-time homebuyers and those with lower credit history, permitting down settlements as low as 3.5%.

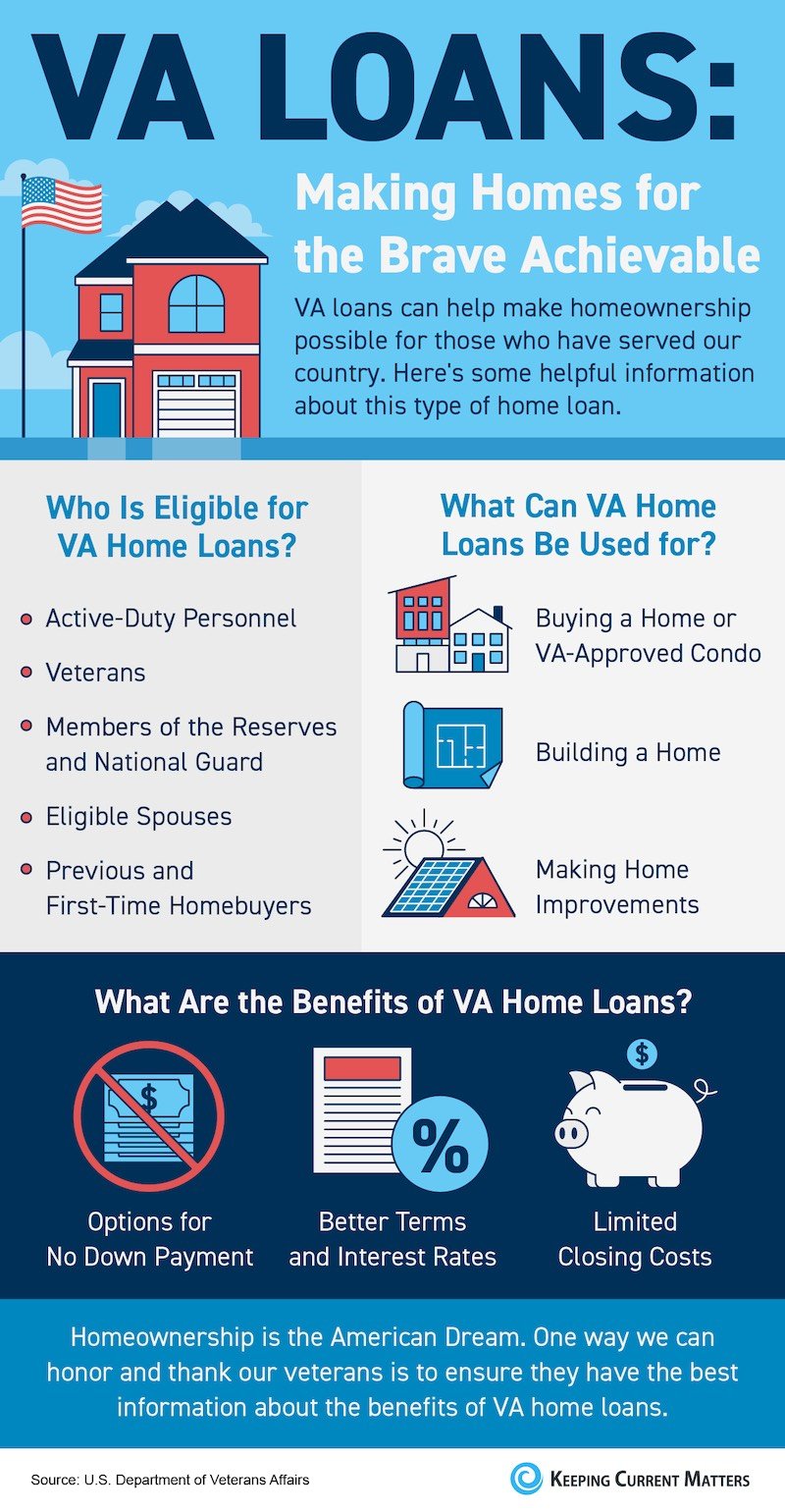

VA fundings, offered to professionals and active-duty armed forces workers, provide beneficial terms such as no down repayment and no personal mortgage insurance (PMI) USDA financings satisfy rural homebuyers, promoting homeownership in less densely inhabited locations with low-to-moderate earnings levels, also needing no down settlement.

Last but not least, adjustable-rate home loans (ARMs) use lower initial rates that change gradually based on market conditions, while fixed-rate home mortgages offer stable regular monthly payments. Recognizing these options makes it possible for potential home owners to make educated decisions, straightening their economic objectives with one of the most suitable car loan type.

Recognizing Rate Of Interest

Rates of interest play a critical function in the home financing process, considerably affecting the general expense of loaning. They are essentially the expense of borrowing money, revealed as a portion of the finance quantity. A reduced rate of interest rate can lead to considerable cost savings over the life of the funding, while a greater rate can result in enhanced monthly payments and total interest paid.

Rate of interest rise and fall based upon different elements, including economic problems, rising cost of living prices, and the monetary policies of reserve banks. Consumers need to recognize dealt with and variable rates of interest. A fixed price remains consistent throughout the lending term, providing predictability in month-to-month settlements. Alternatively, a variable rate can change occasionally based on market conditions, which might lead to reduced preliminary payments but possible boosts over time.

Understanding how passion rates work is critical for possible property owners, as they directly affect cost and monetary preparation. It is suggested to contrast rates from various loan providers, as also a mild distinction can have a significant impact on the complete expense of the car loan. By keeping abreast of market fads, customers can make informed choices that align with their monetary goals.

The Application Process

Browsing the mortgage application procedure can originally seem overwhelming, but comprehending its vital components can simplify the trip. The primary step entails gathering required paperwork, consisting of evidence of revenue, tax obligation returns, and a list of assets and liabilities. Lenders require this information to evaluate your financial stability and creditworthiness.

Following, you'll require to choose a loan provider that lines up with your economic needs. Research different home mortgage items and rate of interest, as these can dramatically influence your monthly payments. When you pick a lending institution, i thought about this you will certainly complete a formal application, which may be done online or personally.

When your application is approved, the lending institution will provide a lending estimate, describing Go Here the terms and costs connected with the mortgage. This critical paper allows you to analyze your options and make informed decisions. Efficiently navigating this application procedure lays a solid structure for your journey toward homeownership and economic stability.

Handling Your Home Loan

Handling your mortgage efficiently is crucial for maintaining monetary health and wellness and ensuring long-lasting homeownership success. An aggressive method to home loan monitoring includes recognizing the terms of your financing, including interest rates, repayment schedules, and any kind of prospective fees. On a regular basis evaluating your home mortgage declarations can aid you remain educated regarding your staying equilibrium and repayment history.

Developing a spending plan that fits your mortgage payments is vital. Make sure that your monthly budget plan includes not just the principal and interest yet likewise real estate tax, home owners insurance, and upkeep expenses. This detailed view will protect against financial stress and unforeseen expenditures.

This strategy can dramatically decrease the complete interest paid over the life of the car loan and reduce the payment period. It can lead to lower month-to-month repayments or an extra beneficial loan term.

Lastly, keeping open communication with your lending institution can offer quality on options offered ought to monetary problems arise. By proactively handling your home mortgage, you can boost your economic stability and reinforce your path to homeownership.

Long-Term Financial Perks

Homeownership offers considerable long-lasting economic benefits that extend beyond simple sanctuary. Among one of the most significant advantages is the potential for home admiration. Over time, genuine estate normally values in worth, allowing homeowners to build equity. This equity functions as an economic property that can be leveraged for future financial investments or to finance major life events.

In addition, homeownership gives tax benefits, such as home loan rate of interest reductions and real estate tax deductions, which can significantly minimize a homeowner's gross income - VA Home Loans. These deductions can result in considerable financial savings, boosting total financial stability

Moreover, fixed-rate mortgages safeguard property owners from rising rental costs, making sure predictable regular monthly repayments. This stability permits people to budget plan efficiently and plan for future costs, helping with long-lasting monetary objectives.

Homeownership also promotes a feeling of neighborhood and belonging, which can cause raised civic engagement and assistance networks, better adding to economic wellness. Inevitably, the economic advantages of homeownership, including equity growth, tax benefits, and expense stability, make it a cornerstone of long-term economic protection and wide range build-up for family members and people web link alike.

Final Thought

In conclusion, understanding home mortgage is important for browsing the course to homeownership and accomplishing financial security. By checking out various financing alternatives, comprehending interest prices, and grasping the application process, possible purchasers equip themselves with the expertise needed to make informed choices. Additionally, reliable home loan management and acknowledgment of long-term economic benefits contribute considerably to developing equity and fostering area engagement. Inevitably, notified options in home financing bring about boosted monetary security and total wellness.

Navigating the intricacies of home fundings is important for any individual aiming to achieve homeownership and establish economic security. As we consider these important components, it becomes clear that the course to homeownership is not simply about protecting a car loan-- it's concerning making informed options that can form your financial future.

Understanding just how rate of interest prices work is important for possible property owners, as they straight influence cost and economic planning.Managing your mortgage successfully is crucial for maintaining financial health and ensuring long-lasting homeownership success.In final thought, understanding home car loans is necessary for navigating the path to homeownership and accomplishing monetary security.

Report this page